stop quote vs trailing stop quote

When the price hits 90 it will. The limit price is then calculated as Stop Price Limit Offset.

Trading Plan Stock Trading Strategies Online Stock Trading Forex Trading Quotes

A normal stop order will turn into a.

. As mentioned before a stop quote simply gets triggered once the market price hits that specified stop quote. A Stop on Quote Order enables an investor to execute a trade at a specified price or better after the quoted stock price reaches the desired stop priceIt is used by investors who want to limit their downside to ensure that a stock is sold before the price falls too far. Open a stock trade ticket.

A buy stop is placed above the current market price. A stop-limit-on-quote order is basically a combination of a stop-loss order with a limit order. Etrade changed the stop loss function some time ago.

If the calculated stop price is reached the order will activate and become a. A stop-limit-on-quote order is an order that an investor places with their broker which combines both a stop-loss order and a limit order. In this example we are going to set the limit offset.

For example a sell trailing stop order sets the. While a stop loss is set at the trade entry to cap a loss a trailing stop is moving to maximize a gain as a trade goes in your favor. A trailing stop loss order adjusts the stop price at a fixed percent or number of points below or above the market price of a stock.

The trail value can be a fixed dollar amount or a percentage. Stop on Quote vs. However the stop price will adjust with changes to the national best bid or offer for the security.

There are different types of stop order approaches and they have diverse applications based on the timing strategies used. A trailing stop order is similar to a traditional stop quote order. To do this first create a SELL order then click select TRAIL LIMIT in the Type field and enter 020 in the Trailing Amt field.

If the stock suddenly crashes to 7 making your sell order at 7 the broker wouldnt execute the stop loss because it is below your limit of 850. It enables an investor to have some downside. Stop Loss on Quote is sell the stock to the BID price when the stock price reaches the set price.

Enter the stock symbol. Learn how Stop Market Stop Limit and Trailing Stop orders can help protect your investments or cap lossesOpen an account. Trailing Stop Limit vs.

In a trailing stop limit order you specify a stop price and either a limit price or a limit offset. A sell stop order is placed below the current market price. The trailing stop is a moving target following a trade.

However the stop price will adjust with changes to the national best bid or offer for the security. By following these steps youll have placed a. Click the Preview button at the bottom of the Trade Ticket page.

Under Stop Price type 95. Under Order Type select SELL along with the quantity 100 shares in this example Under Price Type Select Stop on Quote. If the calculated stop price is reached the order will be activated and become a market order.

The Trailing Stop orders works with US equities options futures FOPS Warrants as well as Forex and certain and certain non-US products. Designed to initiate a sale or purchase when a securities price hits a certain point. For example if you set a stop order with a stop price of 100 it will be triggered only if a valid quote at 100 or better is met.

Limit and Stop-Loss Orders In conclusion limit and stop-loss orders are two of the most commonly used and popular order types when trading stocks because they offer the investor more control over how they react to the markets price discovery process than standard market orders where the investor is agreeing to pay whatever the current market price is. A stop-loss order triggers a market order when a designated price is hit. Bad thing about SLOQ is if there isnt a good BID support you may take a huge loss from what you set your price at as the computer works its way down the BID side selling.

Suppose the price of your security goes way up after you enter the stop order market or limit doesnt matter. A trailing stop limit is an order you place with your broker. A trailing stop is an exit strategy that triggers a stop when a price reverses back enough to signal the possibility that a trend is possibly coming to an end.

An Overview Traders can have more control over their trades by using stop-loss or stop-limit orders. The stop price should be set strategically to minimize loss. A trailing stop order is designed to allow an investor to specify a limit on the maximum possible loss without setting a limit on the maximum possible gain.

Trailing Stop Loss From the examples above it may seem like a trailing stop limit is the obvious choice due to its greater flexibility However do remember that although limit orders allow you to have a lot more control over your trades they also carry additional risks. If the price subsequently drops to your stop price you will sell at the stop price or worse even though in the meantime you could have sold at a so much higher price. Trailing Stop Quote Order A trailing stop quote order is similar to a traditional stop quote order.

The trail value can be a fixed dollar amount or a percentage. Stop orders are triggered when the market trades at or through the stop price depending upon trigger method the default for non-NASDAQ listed stock is last price and then a market order is transmitted to the exchange. Learn how to use a trailing stop loss order and the effect this strategy may have on your investing or trading strategy.

Say you own XYZ right now at 100share but youre afraid itll go down. For example some theories employ general stops such as a 6 trailing stop set on all stocks. For example say you have a stock trading at 10 and you put a stop loss at 9 and a stop limit at 850.

Generally a Stop on Quote is called a stop loss or stop order a stop limit on quote is called a stop limit and a trailing stop is well. Can help protect potential profits while providing downside protection. So you set a stop loss at 90.

It places a limit on your loss so that you dont sell too low. This can be either a buy stop quote or a sell stop quote depending on whether the current market price is above or below the specified stop.

How To Use A Trailing Stop Loss While Day Trading Day Trading Trading Charts Online Stock Trading

T Stop Best Trailing Stop Indicator For Ninjatrader 8 Ninza Co Paint Charts Solar Wind Neon Signs

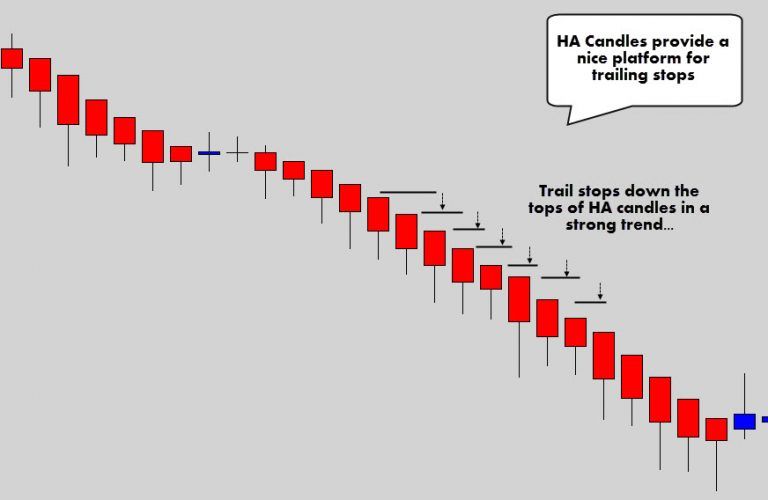

Ha Trailing Stops Trading Charts Wave Theory Trading Quotes

Make 98 Profit Only In 30 Seconds With This Great Trading Platform You Can Make Lot Of Money All You Need To Do Wave Theory Trading Charts Trading Quotes

1 248 Me Gusta 26 Comentarios Forex Training And Strategies Profxtrades En Instagram Do You Us Trading Charts Stock Trading Strategies Intraday Trading

T Stop Best Trailing Stop Indicator For Ninjatrader 8 Ninza Co Paint Charts Rsi Solar Wind

What Is Trailing Stop How To Use It To Make More Profits In Forex Trading Charts Forex Profit

Use An External Intervalometer To Shoot Timelapse Images Dslr Quotes Canon Camera Models Stop Motion Photography

Pin By Ben Petithomme On 4 Hour Work Wek Trading Quotes Stock Trading Strategies Trading Charts

As Part Of Your Trading Strategy You Should Use A Trailing Stop Loss Instead Of A Fixed Profit Target In A Good Tr Trend Trading Trading Quotes Trading Charts

In This Article Discover How To Use A Trailing Stop Loss When Trend Trading Stocks Trend Trading Trading Quotes Trading Charts

Youtube Day Trading Trading Strategies Trading Quotes

Trailing Stop Losses In 2022 Forex Trading Strategies Learn Forex Trading Forex Trading

How To Use A Trailing Stop Loss Show Me The Money Animal Quotes Loss

Pin By E Etcetera On Drama Queen Drama Queen Quotes Drama Quotes Facebook Drama Quotes

Do You Use Trailing Stops While Trading Trailing Stops Are A Great Tool To Use When It Comes To Locking In Profits Or Limiti Investing Value Investing Trading

Stop And Take A Moment To Admire All The Things That You Take For Granted Every Day Inspirational Quotes All Quotes Words

The Aggressive One Bar Trailing Stop Loss For Quick Trades Trading Investment Advice Swing Trading

Trailing Stop Stop Loss Combo Leads To Winning Trades Loss Trading Led